Tax Codes – how do they work?

As a business owner, payroll is highly likely on your agenda. If you have employees, irrespective of whether you manage your payroll in-house or outsource it, it’s something you need to look after on a regular basis.

An important part of any payroll activity is making sure that you’re applying the right tax codes for your employees. While tax codes themselves are made up of a short, very simple combination of a few numbers and letters, it is useful as a business owner to understand how they work.

In this article, we’ll look at the make-up of tax codes, how they work and what you should do if you need help.

What is a tax code?

Tax codes are a combination of numbers and letters that are used by employers and pension providers to work out how much Income Tax they need to take from their employee’s pay or pension payments.

How do they work?

What do the numbers and letters mean?

The numbers part

The numbers in a tax code are made up of the following:

- An individual’s tax-free personal allowance that is calculated by HMRC.

- The amount of income that they have received and haven’t paid tax on plus any benefits from their job that need to be taxed*.

- Deducting the income that hasn’t had tax paid on it from their tax-free allowance.

- The removal of the last digit.

Tax-free allowances

Tax-free allowances are made up of an individual’s Personal Allowance, Blind Person’s Allowance, any pension contributions or charity gifts that they may have made, as well as interest payments they’ve made to qualifying loans.

Unpaid tax and job benefits

If an individual has tax that’s unpaid from a previous period or if they have job-related benefits, such as a company car, medical insurance or accommodation, these will be taken into account at step 2* above.

Once these figures have been established, any unpaid tax or job benefits will be deducted from the tax-free allowance. The resulting number will then have the last digit removed and that’s what makes up the numbers part of any tax code.

The letters part

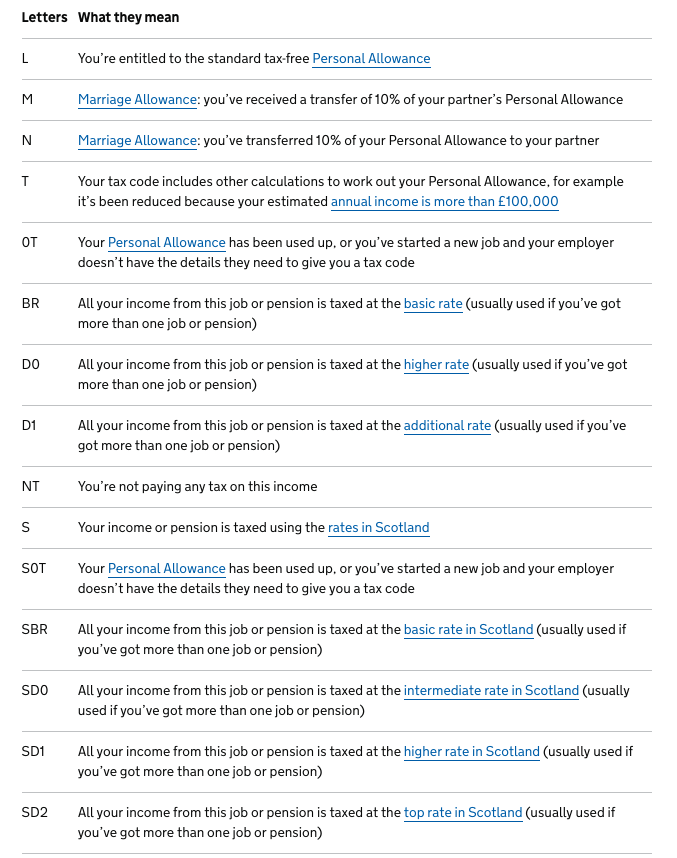

The letters in a tax code depend on an individual’s unique situation. Here’s a table from www.gov.uk to explain what they mean:

There are also tax codes that have W1 or M1 at the end. These are emergency tax codes. Tax codes with a K at the beginning means that someone’s income is worth more than their tax-free allowance.

Who should have a tax code?

In the UK, everyone who is paid within a PAYE scheme is allocated a tax code.

Who issues tax codes?

HMRC is responsible for issuing tax codes to make sure that employers and pension providers collect the right amount of tax. There are different ways that an employer can obtain a tax code for an employee.

Typically, tax codes will be communicated via a P45 when a new employee joins a company. Another way of obtaining a tax code is via the HMRC Notice of Coding which is sent to the employer, with a copy going to the employee. This document is often referred to as a P6 or a P9 notice. In addition, annual ‘blanket’ changes to tax codes are issued by HMRC using form P9X. After the annual budget, any changes are notified via the form P7X.

Where can you find a tax code?

You’ll be able to see an employee’s tax code on their payslip, their coding notice that they get from HMRC, their P60 or their P45.

How to solve tax code problems

It’s not uncommon for employers, and indeed employees to have issues with tax codes. For employees, one of the most common issues is when emergency tax codes are used, or when their circumstances have changed. It is important for employees to make sure that they tell HMRC of any changes that might affect their tax code. They can do this simply and easily online.

As an employer, it’s essential to check that you’re working with the right tax codes for your employees. That said, accidents do happen and occasionally you might find yourself in a situation whereby you have to resolve a tax code issue. Some of the most common issues that employers face are:

- They didn’t use the right tax code when a new employee started.

- They applied a tax code without agreement from HMRC.

- They didn’t use the same tax code in a new tax year, when no updated code had been issued.

- Not taking account of tax codes that they’ve received electronically.

- Using out of date PAYE tables.

- Encountering data input issues.

The key thing as an employer is that you do your very best to use the most up to date tax code for your employees.

If you are challenged, either by an employee or by HMRC regarding a tax code error, it is your responsibility to be able to defend yourself in the event of an enquiry from either of these parties. Facing this type of questioning can be tough if you’re not accustomed to dealing with disgruntled employees or indeed HMRC. This is where having a payroll provider you can trust on your side is worth its weight in gold.

At Payplus we run around 1000 payrolls every month, process approximately 50,000 payslips monthly and pay £400 million each year through the Bacs system on behalf of our clients. What this means is that we know what we’re doing.

It wouldn’t be possible to say that accidents never happen. Of course, they do, but when you choose to pass your payroll to Payplus, you know that you have a team of experts on your side.

Should you have an issue with a tax code, or indeed with any other aspect of your payroll, we know how to sort it out with the minimum of stress and disruption. What this means is that you can get on with doing what you do best – running your business – and leave the rest to us.

If you’d like help with your tax codes or any other aspect of your payroll, all you need to do is get in touch.

IRIS Software Group Expands Managed Payroll Services Offering With Payplus Acquisition

28th July 2021: IRIS Software Group (IRIS), one of the UK’s largest privately owned software companies, is today announcing it has acquired Payplus, the best-in-class…

Finish ReadingRebuilding Your Business After Lockdown (Part 2: Drilling Deeper)

Why now’s a great time to set some new habits in place Since the start of 2020, the whole fibre of our daily lives has…

Finish ReadingRebuilding Your Business After Lockdown (Part 1: The Basics)

There are very few business owners who would say that their business hasn’t changed because of the pandemic. Some have pivoted and thrived, others have…

Finish ReadingGetting Staff Ready to Return After Lockdown

Most of us have spent more time at home in the last year than at any other time in our working lives. For some, this…

Finish ReadingPreparing for the Post-Covid Workplace

The roll out of businesses opening up after lockdown is gathering speed. No matter whether you’re a small or medium-sized business owner who welcomes the…

Finish Reading